Tax Planning – A Comprehensive Guide

If you want to avoid tax season stress, a comprehensive approach to tax planning can help. It includes understanding tax laws, maximizing deductions, and using credits.

Planning can save you money whether you are an individual, a family, a business, or an estate. It also helps you keep your finances organized and plan for the future.

Tax planning

Taxes are a necessary part of life but can also be very stressful. Whether you’re a person, a small business owner, or a large estate, you need sound tax planning and preparation Somerville NJ., approach to reduce your tax payments and increase your returns.

Taking advantage of tax-advantaged opportunities throughout the year rather than waiting until filing time is an intelligent approach to tax planning. Advanced planning is essential to avoid surprises and prepare for new laws and regulatory guidance.

Identifying and implementing a tax-advantageous strategy can help you save money and build wealth over the long term. For example, making a like-kind exchange in real estate can reduce your tax liability and increase your portfolio value.

Tax laws

Tax law is the rules and policies governing how taxes are assessed, collected, and administered. It includes charges on estates, transactions, property, income, licenses, and more. It also includes duties on imports from foreign countries and all compulsory levies imposed by the government for the benefit of the state.

Tax laws are based on various sources, including federal legislation, tax code sections, regulations, administrative codes, and procedures issued by the relevant authorities. The Internal Revenue Code (IRC) is a significant source of tax law that Congress enacts.

The IRS implements the law through its Treasury Regulations and Revenue Rulings. These can be found in Title 26 of the U.S. Code, an electronic version available online for free. In addition, a special trial court is set up to hear disputes over the administration of federal income, estate, and gift taxes. A panel hears these cases of 19 presidentially appointed judges.

Tax deductions

Tax deductions are one of the three primary tax incentives the government uses to encourage taxpayer behavior that strengthens the economy. It includes things like home ownership and retirement savings.

Tax deductions come in two flavors: primary and itemized. Both lower a person’s taxable income, but they do it differently.

A higher-income tax filer typically receives a more significant tax benefit from itemized deductions than the standard deduction. It is because they may have a more substantial percentage of their income that isn’t taxable.

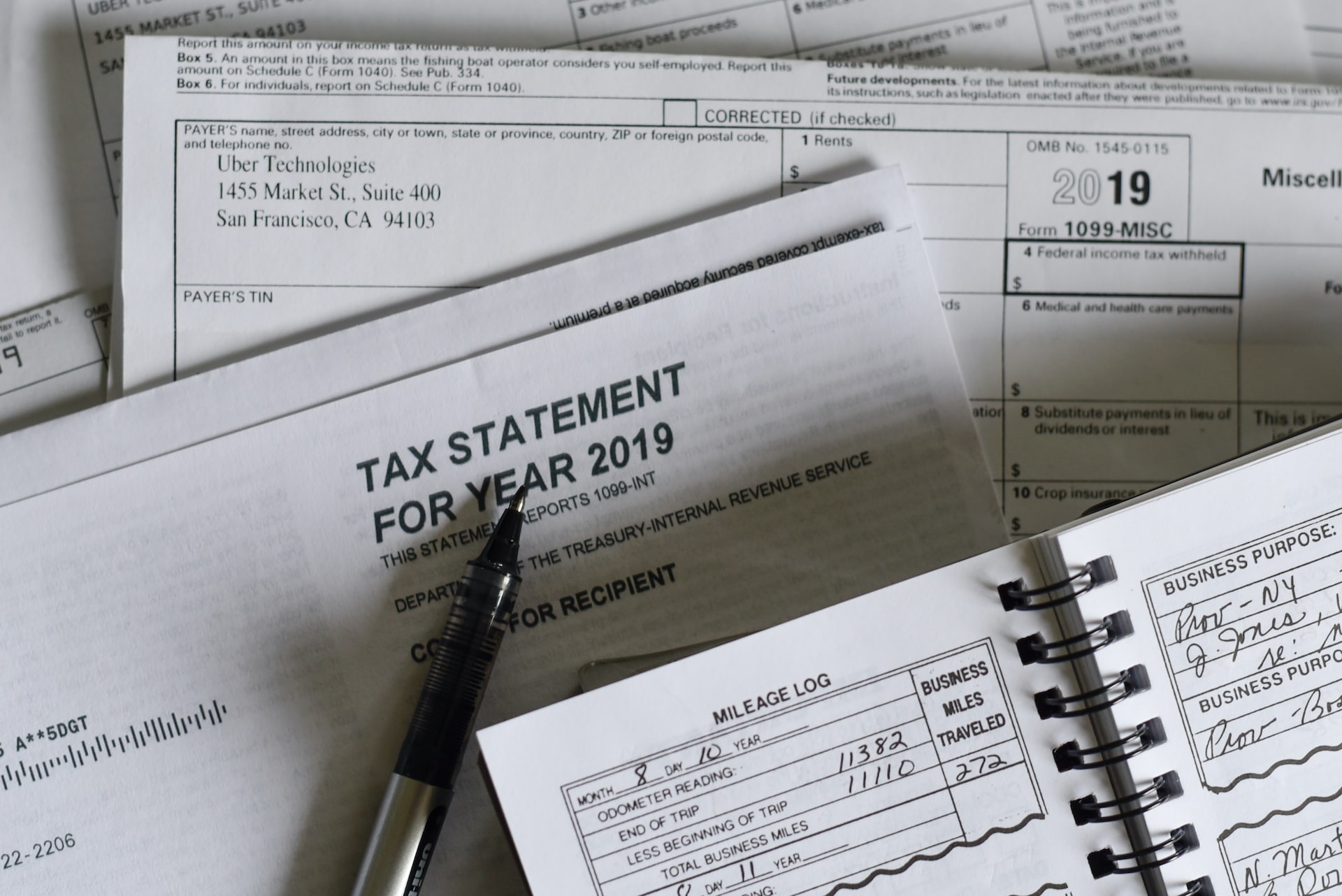

There are many different tax deductions that you can claim, including state taxes, charitable contributions, mortgage interest on a home, and many more. The key is keeping track of all deductible expenses throughout the year and ensuring you have receipts.

Tax credits

A tax credit is a type of economic development subsidy that lowers a company’s taxes by enabling it to deduct all or some of an unavoidable expense from its income tax liability on a dollar-for-dollar basis. They can be treasured for capital-intensive manufacturing industries like oil and gas or research and development.

In many cases, state governments negotiate these credit programs on a project-by-project basis with companies. It means that a company may have to prove that it would only proceed with its project in that geography if it received the tax benefits offered.

Tax credit laws often include reporting requirements and clawbacks that empower the government to reclaim the number of tax credits it awards, with interest or penalties, if the company is found non-compliant. Keeping track of deadlines and meeting compliance obligations can be time-consuming and complex.